Claim Your Complementary Business Risk Assessment:

Safeguard Your Business Against Adversity with

G&S Insurance Brokers

Claim Your Complementary Business Risk Assessment:

Safeguard Your Business Against Adversity with

G&S Insurance Brokers

We insure more than 6438 clients who each have their own expertly crafted custom insurance packages tailored to their needs!

We get it.

You want to empower your business by unveiling risks & simplifying business protection.

How can you do this if you:

1.

Have a limited understanding of how holistic business protection encompasses asset protection, leadership safeguarding, employee wellbeing, and business continuity.

2.

Lack awareness about the full spectrum of risks your business face.

3.

Find it challenging to navigate through the complexities of tailoring insurance solutions to match your unique business needs.

4.

Feel constrained by time and are delaying seeking comprehensive protection for your business due to scheduling conflicts or perceived lack of time.

5.

Do not anticipate the full extent of risks, like cybersecurity breaches or supply chain disruptions, that could significantly impact your business.

We confidently know how to safeguard businesses from personal debt liability, supply chain vulnerabilities, asset damage or theft, business interruption, and the potential loss of key personnel due to unforeseen perils and so much more.

This Is How We Can Make It Happen For You:

Step 1

Click on the button to claim your complementary risk assessment.

Step 2

You will then be sent a link via email to fill in a survey where we gain a better understanding of your business.

Step 3

You will receive a risk outcome based on your answers.

Step 4

One of our representatives will be in contact with you to discuss your result.

You won't have any obligation to commit to any of our services.

We get it.

You want to empower your business by unveiling risks & simplifying business protection.

How can you do this if you:

1.

Have a limited understanding of how holistic business protection encompasses asset protection, leadership safeguarding, employee wellbeing, and business continuity.

2.

Lack awareness about the full spectrum of risks your business face.

3.

Find it challenging to navigate through the complexities of tailoring insurance solutions to match your unique business needs.

4.

Feel constrained by time and are delaying seeking comprehensive protection for your business due to scheduling conflicts or perceived lack of time.

5.

Do not anticipate the full extent of risks, like cybersecurity breaches or supply chain disruptions, that could significantly impact your business.

We confidently know how to safeguard businesses from personal debt liability, supply chain vulnerabilities, asset damage or theft, business interruption, and the potential loss of key personnel due to unforeseen perils and so much more.

This Is How We Can Make It Happen For You:

Step 1

Click on the button to claim your complementary risk assessment.

Step 2

You will then be sent a link via email to fill in a survey where we gain a better understanding of your business.

Step 3

You will receive a risk outcome based on your answers.

Step 4

One of our representatives will be in contact with you to discuss your result.

You won't have any obligation to commit to any of our services.

How Do I Know If G&S Insurance Can Help My Business:

Do you currently fit into one of the roles below?

Business Owners and Entrepreneurs

Professional Managers

High-net-worth individuals and investors

HR Director or Finance Manager

Do you currently fit into one of the roles below?

Business Owners and Entrepreneurs

Professional Managers

High-net-worth individuals and investors

HR Director or Finance Manager

We Offer Protection Tailored for You.

Protection for Directors:

Comprehensive estate and succession planning for directors' protection.

Employee Security & Benefits:

Group life, healthcare, and pension fund for your employees' security.

Business Asset Protection:

Commercial lines cover and institutional investments for safeguarding business assets.

Business Continuity:

Safeguarding Operations Against Unforeseen Disruptions

Click the button below so we can kickstart your journey to becoming invincible against adversity!

We Offer Protection Tailored for You.

Protection for Directors:

Comprehensive estate and succession planning for directors' protection.

Employee Security & Benefits:

Group life, healthcare, and pension fund for your employees' security.

Business Asset Protection:

Commercial lines cover and institutional investments for safeguarding business assets.

Business Continuity:

Safeguarding Operations Against Unforeseen Disruptions

Click the button below so we can kickstart your journey to becoming invincible against adversity!

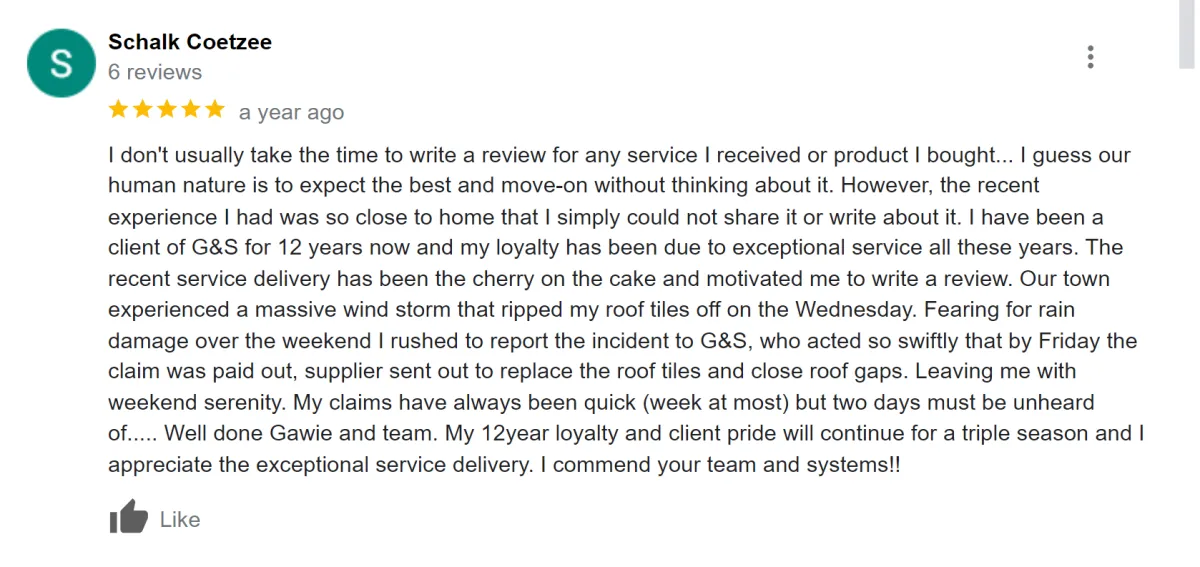

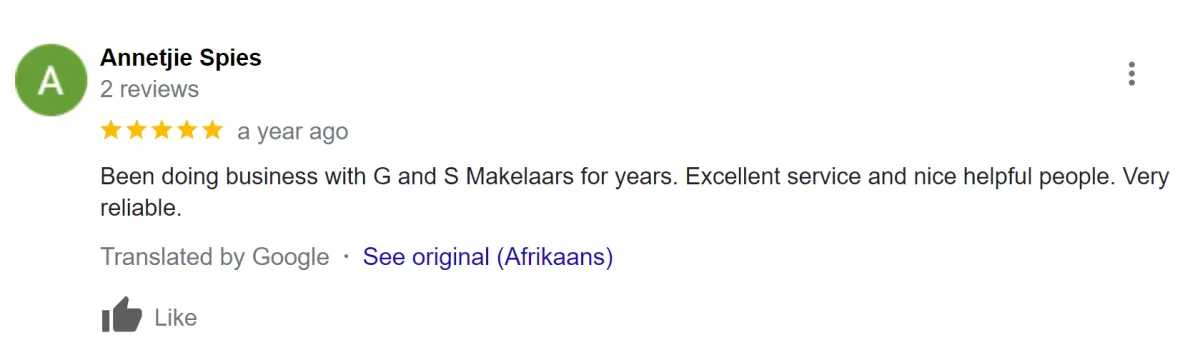

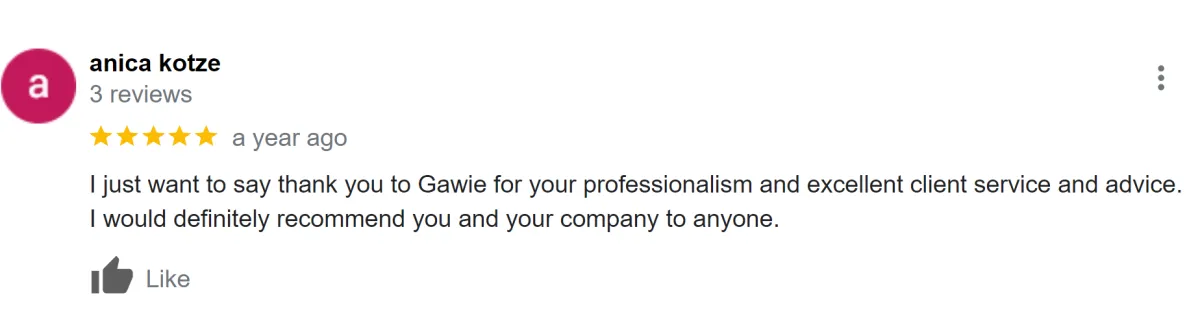

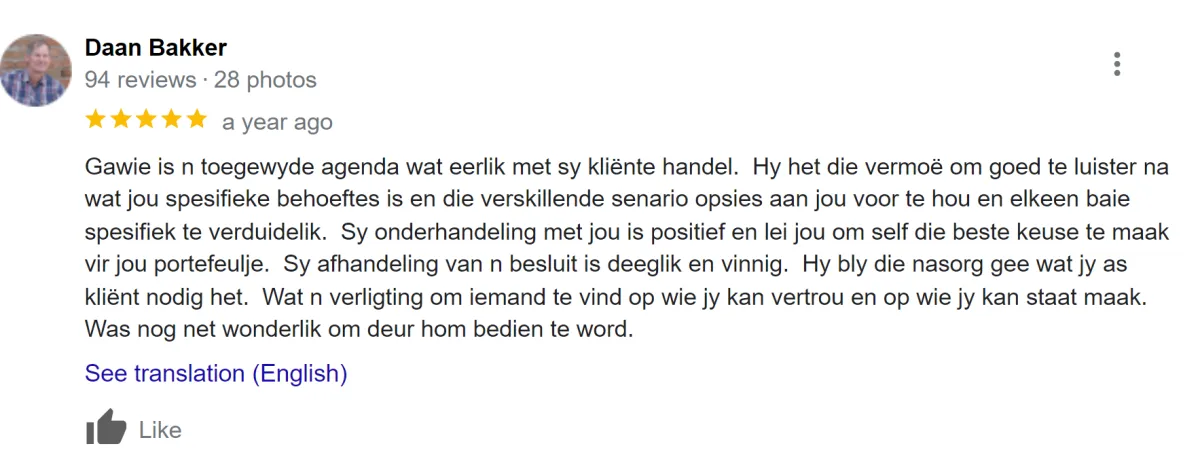

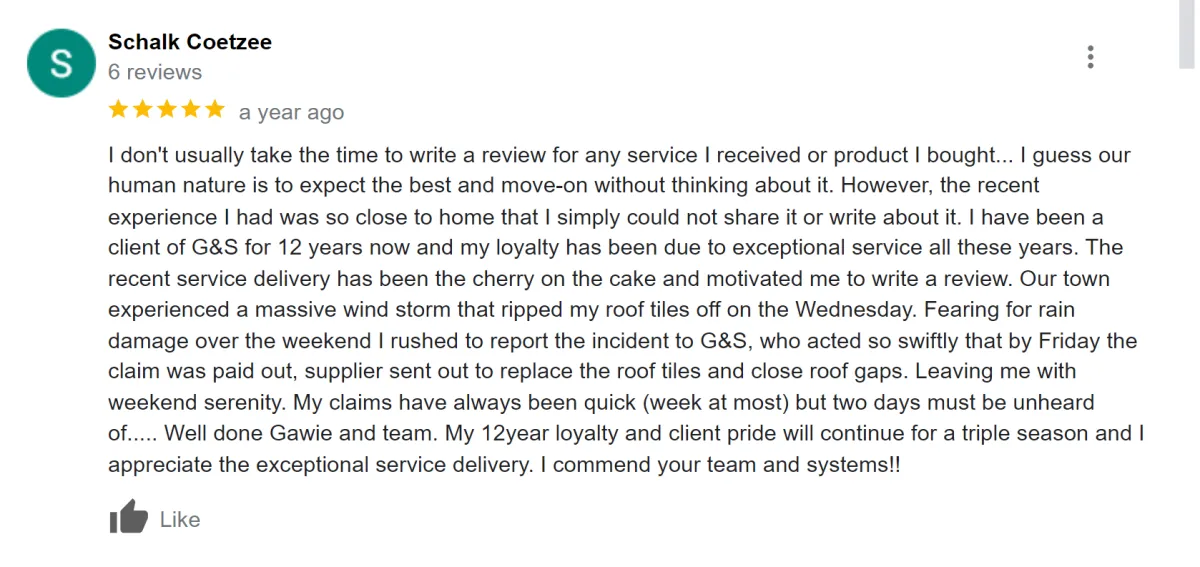

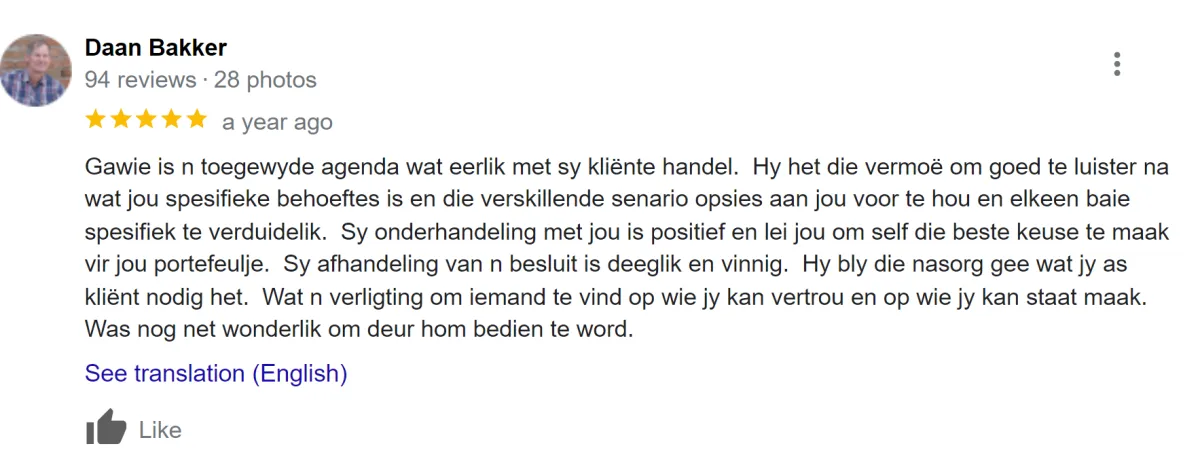

What Our Clients Have To Say About Us:

What Our Clients Have To Say About Us:

Why Trust G&S Insurance Consultants:

More than R500 million in assets under management.

More than 30 years experience.

Accreditation with multitude of insurance providers

We currently insure 6438+ clients.

Why Trust G&S Insurance Consultants:

More than R500 million in assets under management.

More than 30 years experience.

Accreditation with multitude of insurance providers

We currently insure 6438+ clients.

Real Businesses, Real Results

See How We Support Businesses

Paint Manufacturer

Before transitioning to G&S Insurance Consultants

A leading paint manufacturer faced rising costs and limited options in employee benefits. Their previous insurance provider struggled to offer tailored, cost-effective solutions.

Following a strategic shift to G&S

A customized and sustainable insurance program that aligns precisely with the company's budgetary requirements, offering comprehensive employee benefits and medical aid solutions. This tailored insurance strategy not only safeguards the company's financial interests but also prioritizes the well-being of its invaluable workforce."

Furniture Company

Before partnering with G&S Insurance Consultants

A renowned furniture company grappled with vulnerabilities in protecting their business assets against potential disruptions, damages, and various commercial risks. Their existing insurance coverage lacked a comprehensive approach, leaving gaps in securing assets, particularly during critical events such as disability, illness, or loss of key personnel.

After a strategic collaboration with G&S

G&S fortified not only the business assets against interruptions and damages but also implementing an inclusive plan for the directors.

The outcome? A fortified shield around the company's business and the personal well-being of its leadership, offering a reassuring sense of security and stability amid unforeseen challenges.

Engineering Company

Before partnering with G&S Insurance Consultants

A prestigious engineering firm encountered difficulties in securing a specialized solution for executive-level employee benefits. The existing strategy fell short in addressing the firm's unique needs, especially in retaining top-tier talent and acknowledging the inherent value within their workforce.

After collaborating with G&S

The solution not only enhanced employee retention but also highlighted the firm's commitment to their workforce's well-being and satisfaction. The outcome? A bolstered workforce and an elevated competitive stance within the engineering industry.

Real Businesses, Real Results

See How We Support Businesses

Paint Manufacturer

Before transitioning to G&S Insurance Consultants

A leading paint manufacturer faced rising costs and limited options in employee benefits. Their previous insurance provider struggled to offer tailored, cost-effective solutions.

Following a strategic shift to G&S

A customized and sustainable insurance program that aligns precisely with the company's budgetary requirements, offering comprehensive employee benefits and medical aid solutions. This tailored insurance strategy not only safeguards the company's financial interests but also prioritizes the well-being of its invaluable workforce."

Furniture Company

Before partnering with G&S Insurance Consultants

A renowned furniture company grappled with vulnerabilities in protecting their business assets against potential disruptions, damages, and various commercial risks. Their existing insurance coverage lacked a comprehensive approach, leaving gaps in securing assets, particularly during critical events such as disability, illness, or loss of key personnel.

After a strategic collaboration with G&S

G&S fortified not only the business assets against interruptions and damages but also implementing an inclusive plan for the directors.

The outcome? A fortified shield around the company's business and the personal well-being of its leadership, offering a reassuring sense of security and stability amid unforeseen challenges.

Engineering Company

Before partnering with G&S Insurance Consultants

A prestigious engineering firm encountered difficulties in securing a specialized solution for executive-level employee benefits. The existing strategy fell short in addressing the firm's unique needs, especially in retaining top-tier talent and acknowledging the inherent value within their workforce.

After collaborating with G&S

The solution not only enhanced employee retention but also highlighted the firm's commitment to their workforce's well-being and satisfaction. The outcome? A bolstered workforce and an elevated competitive stance within the engineering industry.

We Are Accredited With:

We Are Accredited With:

EXCOAL SOLAR - @2021 All Rights Reserved

EXCOAL SOLAR - @2021 All Rights Reserved

EXCOAL SOLAR - @2021 All Rights Reserved

EXCOAL SOLAR - @2021 All Rights Reserved

G&S Insurance @2023 All Rights Reserved

G&S Insurance @2023 All Rights Reserved

EXCOAL SOLAR - @2021 All Rights Reserved

EXCOAL SOLAR - @2021 All Rights Reserved

EXCOAL SOLAR - @2021 All Rights Reserved